When it comes to building a successful career in finance, the Chartered Financial Analyst course. The greater the effort you put in, the more benefits you will reap, and the more opportunities will arise. So, get more insights about what the CFA course has for you, the benefits it offers, its content, and other important details that can guide you on this exciting adventure.

The CFA course is offered by the CFA Institute, designed for those interested in careers in finance and investment. The CFA designation is recognized worldwide, making it a highly regarded credential in the financial industry.

Contents

Why Choose the CFA Course?

- The CFA charter is recognized and respected in many countries. Companies across the globe value the expertise and ethical standards associated with CFA charter holders.

- Completing the CFA program opens up diverse career paths in finance. Whether you want to work in investment banking, hedge funds, private equity, or wealth management, having the CFA designation on your resume can significantly enhance your job prospects.

- The CFA curriculum covers a comprehensive range of financial topics, from ethics and investment tools to portfolio management and performance measurement. This knowledge can empower you to make informed investment decisions.

- Joining the CFA community gives you access to a vast network of finance professionals. This network can lead to mentorship opportunities, job referrals, and invaluable industry insights.

- The rigorous nature of the CFA program cultivates discipline, time management, and analytical skills. These traits are beneficial not only in your professional life but also in personal growth.

The CFA Program Structure

The CFA course consists of three levels of exams that cover a wide range of topics. Each level a thorough understanding of essential financial concepts. This structured approach helps candidates become well-rounded finance professionals and each level is with distinct focuses:

Level I: Basic Knowledge and Tools

The first level introduces candidates to the fundamentals of investment tools and financial analysis. Key topics include. Level I is primarily focused on knowledge and comprehension, with exams consisting of multiple-choice questions. A glimpse of the Level 1 is: –

- Basic statistical and mathematical techniques used in finance.

- Micro and macroeconomic principles affecting the financial markets.

- Analysing financial statements to assess the performance of the company

- Key concepts in corporate financial management.

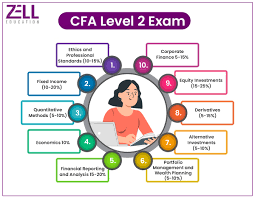

Level II: Asset Valuation and Analysis

Level II builds on the concepts learned in Level I, emphasizing asset valuation techniques. Key areas include: –

- Advanced financial statement analysis.

- Techniques for valuing stocks and equity securities.

- Understanding and valuing bonds and other fixed-income instruments.

- Introduction to options, futures, and other derivatives.

- Evaluating and managing investment portfolios.

The Level II exam includes both multiple-choice questions and item set questions, which require deeper analysis and application of concepts.

Level III: Portfolio Management and Wealth Planning

The final level focuses on portfolio management and the wealth management process. Key topics include:

- Strategies for constructing and managing investment portfolios to meet client objectives.

- Assessing the performance of investment portfolios and developing strategies for improvement.

- Identifying and managing risk in investment portfolios.

- Understanding how psychological factors affect investment decisions.

Level III features both essay questions and multiple-choice questions, allowing candidates to demonstrate their ability to apply concepts in real-world scenarios.

Exam Structure and Preparation

The CFA exams are known for their rigor and depth. Here’s how the exam structure looks:

- Level I: 240 multiple-choice questions, divided into two 3-hour sessions.

- Level II: 120 multiple-choice questions and item set questions.

- Level III: A mix of essay questions and multiple-choice questions.

To prepare effectively, candidates typically need to devote around 300 hours of study per level. Many candidates utilize a combination of study guides, practice exams, and online resources. Joining study groups or classes can also provide valuable support and motivation.

Eligibility Requirements for CFA Enrolment

To enrol in the CFA program, candidates need to meet specific eligibility criteria. You must have a bachelor’s degree or equivalent, or you can be in your final year of undergraduate studies.

Preparation for CFA

Balancing work, study, and personal life can be challenging while preparing for the CFA exams. Studying from a CFA coaching institute like Zell Education will help you out to prepare for the exams effectively and with considerate efforts.

Become A CFA

The CFA designation is a significant step toward a rewarding career in finance. The program offers in-depth knowledge, valuable skills, and networking opportunities that can help you succeed in various finance roles.

The CFA qualification can lead to exciting career advancements, high earning potential, and a respected place in the financial world.

So, if you are passionate about finance and committed to your goals, consider enrolling in the CFA program. Your dedication could be the key that unlocks a world of opportunities! let the CFA course be your success journey in the finance industry.